What Is a Credit Note and When Should You Use One?

If you run a small business or freelance service, chances are you've issued an invoice — but what happens when you need to cancel or adjust that invoice? That’s where a credit note comes in.

In this post, we’ll break down:

- ✅ What a credit note is

- 💡 Why it’s important

- 📅 When to use one

- 🛠 How to create one easily with EasyGoInvoice

✅ What Is a Credit Note?

A credit note (or credit memo) is a formal document issued by a seller to a buyer that reduces the amount the buyer owes from a previously issued invoice.

Think of it as the opposite of an invoice — instead of requesting payment, you’re correcting or reversing it.

🔍 Why Are Credit Notes Important?

- They keep your accounting accurate

- They help you comply with tax and legal regulations

- They build trust and transparency with your clients

- They allow you to void or revise invoices without deleting records

📅 Common Situations When You Should Use a Credit Note

Here are the most common use cases:

1. Customer Overpaid

If a client accidentally paid more than the invoice amount, a credit note reflects the overpayment and balances the books.

2. Returned Goods or Services Not Rendered

If a product is returned or a service was not fully delivered, use a credit note to adjust the amount.

3. Invoice Error

Mistyped the amount? Wrong tax? Instead of editing the original invoice, issue a credit note to void or correct it.

4. Discounts Applied After Billing

If a discount is approved after the invoice was sent, apply it via a credit note to adjust the final amount due.

💼 Real-World Example

Let’s say you issued an invoice for $10,000. Later, the client returned items worth $2,000. You should issue a credit note for $2,000, indicating the updated balance owed is $8,000.

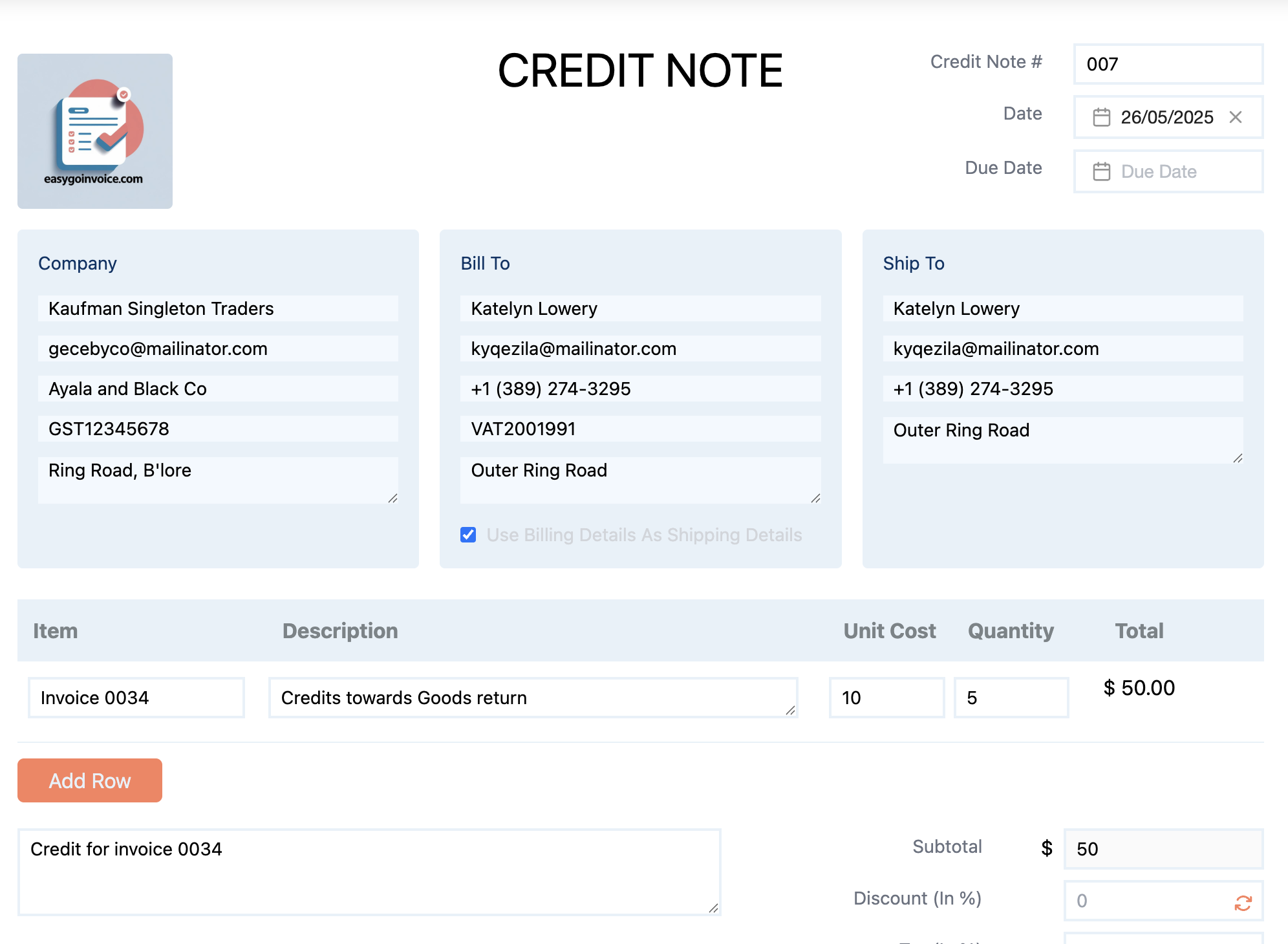

✍️ What Should Be Included in a Credit Note?

A professional credit note should include:

- Credit Note Number

- Reference to the Original Invoice

- Date of Issue

- Customer Details

- Reason for Issuance

- Adjusted Amount

- Your Business Information

🧾 How to Create a Credit Note with EasyGoInvoice

Creating a credit note has never been easier:

- Go to EasyGoInvoice.com

- Click on the “Credit Note” option

- Fill in the client and document details

- Add reference to the original invoice and reason for adjustment

- Preview and download it instantly — no account required!

✨ New Feature: You can now save your Terms for future use, making repeat credit notes even faster to generate.

🧠 Final Thoughts

Credit notes are essential for professionalism, compliance, and trust in business dealings. Whether you're refunding, correcting, or adjusting a transaction, issuing a credit note ensures your records remain clean and accurate.

With EasyGoInvoice, you can create and manage credit notes easily — right from your browser, without needing an account.

📩 Have questions? Email us anytime at support@easygoinvoice.com