How to Write Payment Terms That Actually Get You Paid on Time

Late payments are one of the biggest challenges freelancers, small businesses, and startups face. Often, the problem isn’t the client — it’s unclear or weak payment terms in your invoice.

In this post, we’ll show you how to write clear, firm, and professional payment terms that get you paid faster — with real-world examples you can use right away.

✅ What Are Payment Terms?

Payment terms are the conditions you set for when and how clients should pay you. This includes:

- Due date

- Accepted payment methods

- Late fees

- Early payment incentives (optional)

Why Clear Payment Terms Matter

- 🕒 Reduce payment delays

- 💸 Encourage faster payments

- 📑 Avoid confusion and disputes

- 📈 Maintain cash flow and financial health

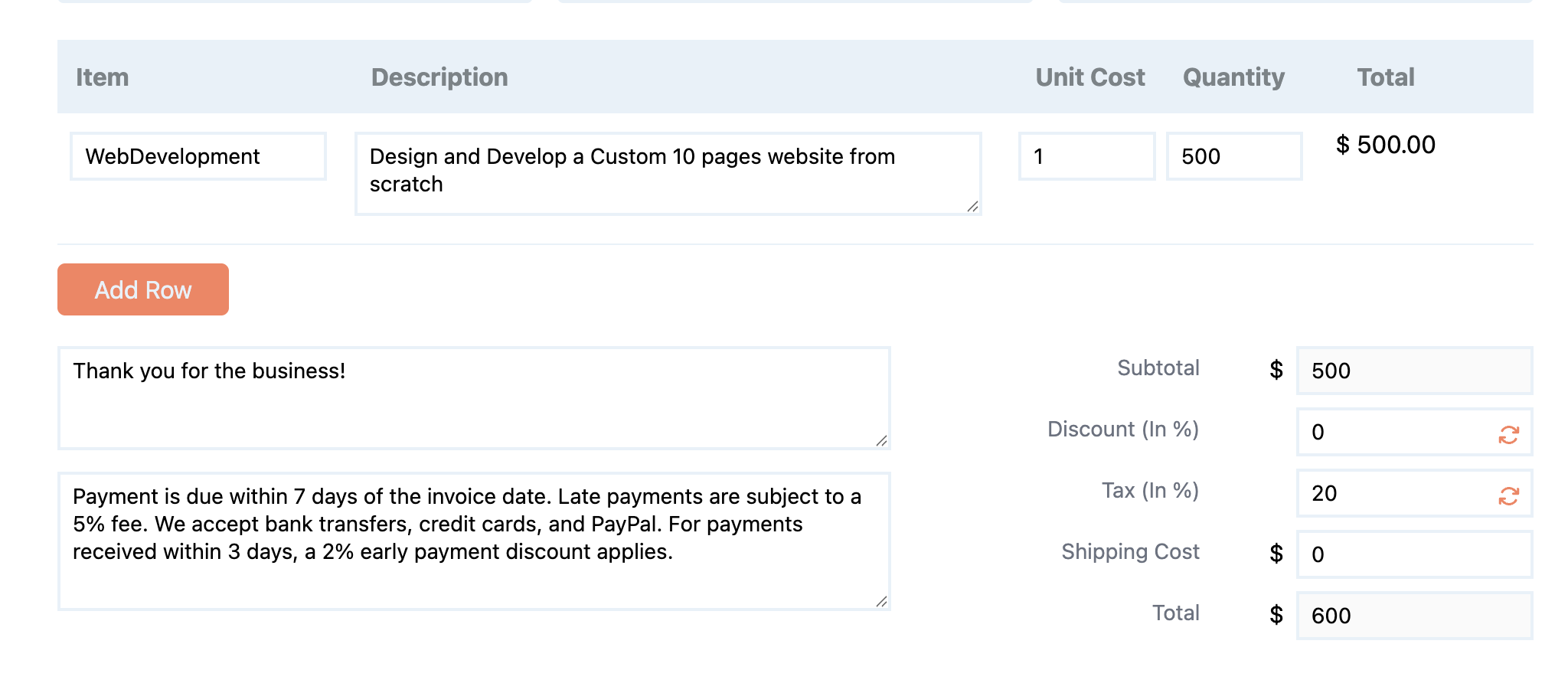

Real-World Example 1: Freelance Web Designer

Let’s say you're a freelance web designer. Here’s an example of strong payment terms to include in your invoice:

🧾 Payment Terms Example (Freelancer):

"Payment is due within 7 days of the invoice date. Late payments are subject to a 5% fee. We accept bank transfers, credit cards, and PayPal. For payments received within 3 days, a 2% early payment discount applies."

Why This Works:

- Clear deadline: “Within 7 days” gives clients a specific time frame.

- Late fee policy: Encourages on-time payment.

- Payment methods: Reduces excuses or delays.

- Early discount: Motivates fast action.

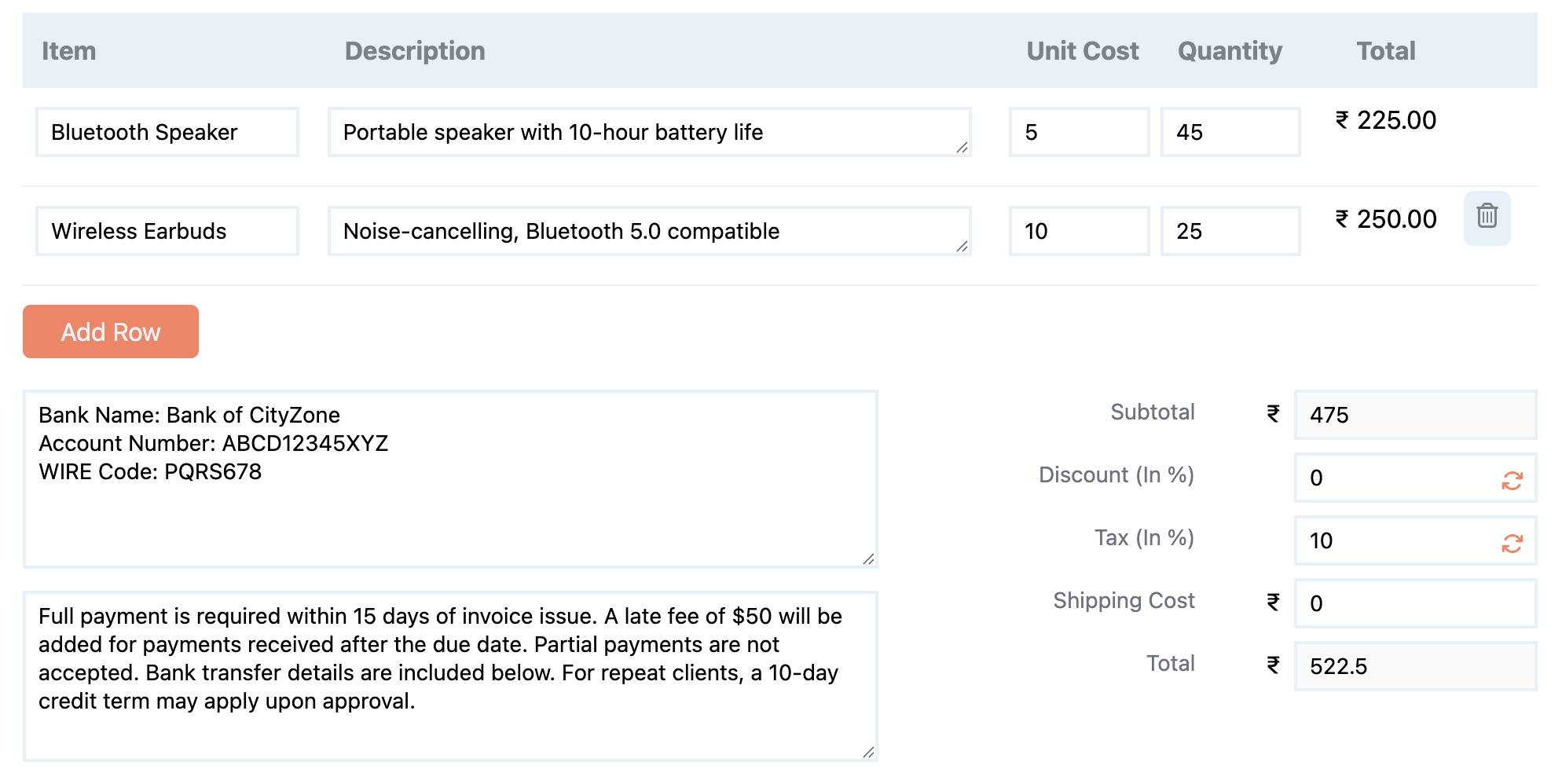

Real-World Example 2: Small Manufacturing Business

If you sell physical goods or provide recurring B2B services, you might need a different approach.

🧾 Payment Terms Example (Small Business):

"Full payment is required within 15 days of invoice issue. A late fee of ₹250 will be added for payments received after the due date. Partial payments are not accepted. Bank transfer details are included below. For repeat clients, a 10-day credit term may apply upon approval."

Why This Works:

- Firm deadline and late fee: Encourages prompt settlement.

- No partial payments: Prevents confusion or miscommunication.

- Client-based flexibility: Builds trust for returning customers while maintaining control.

Tips for Writing Effective Payment Terms

1. Use Plain Language

Avoid legal jargon. Keep it simple, like:

"Please pay within 14 days to avoid late fees."

2. Be Specific

Instead of “Due on receipt,” write:

"Due by specific date" — this creates urgency.

3. Mention Late Fees (and Stick to Them)

Example:

"A 2% late fee will be charged for each week past the due date."

4. Offer Incentives

Early payment discounts can be surprisingly effective. Example:

"Get 5% off when paid within 3 days."

5. Repeat Terms on Every Invoice

Don’t assume clients will remember — reinforce payment expectations on every document.

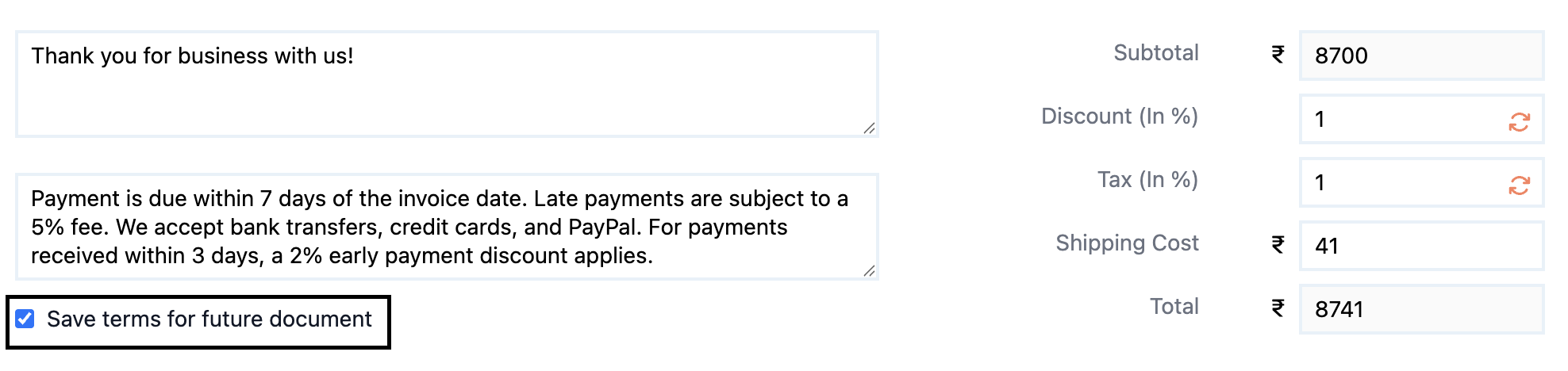

Add Terms Easily with EasyGoInvoice

With EasyGoInvoice, you can:

- Set and reuse payment terms in every document

- Customize your invoice footer with specific instructions

- Avoid editing every invoice manually

- ✅ Now Save Terms for Future Use — Easily store your commonly used payment terms and apply them with one click when creating new invoices, quotes, or credit notes.

This new feature helps you work faster and stay consistent with your client communications.

Bonus: Store all your invoices locally with no login required, and manage them from the History tab!

Final Thoughts

Writing clear payment terms doesn’t just get you paid on time — it shows professionalism and sets healthy boundaries with clients.

Start small: update your invoice template today with these best practices and test the results. You’ll be surprised how big a difference a few words can make.

👉 Need help setting this up? Reach out to us at support@easygoinvoice.com — we’re happy to help!